The Current Stage of the Business Cycle

October 23, 2017

Some investors, currency traders, and economists are worried about the current unsustainable state of the economy and some predict a sudden downturn in the future. The stock market has reached record levels, drastically inflating the evaluation of companies and stock prices. President Trump is taking credit for the boom, and so is Fed chairlady, Janet Yellen, on behalf of the Federal Reserve. Economists of different schools have weighed in on the unsettled matter, some claiming that that a crash is not on the horizon.

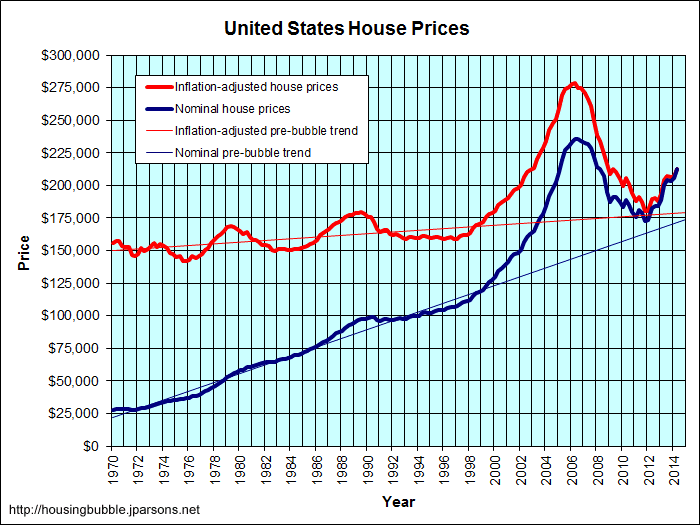

The importance of the future economy in relation to the current is self-evident, especially for young people hoping for a smooth entrance into the productive world. Many long-term projects and investment such as a collegiate education and entrepreneurial start-ups require good credit linked to the interest rates. A prominent issue is college loan interest rates which are completely correlated to the general interest rate of money. While lowering interest rates makes credit for students cheaper in the short term, just as with the housing market in 2008 and today, it is better for the market to determine interest rates without government perturbance.

In addition, a major issue to the minds of young people is unfair economic inequity or inequality; there is sufficient evidence to show that inflation and quantitative easing causes a concentration of wealth to the rich at the expense of the poor. The Federal Reserve loans newly printed money first to large banks and corporations before prices can compensate. Before this new money trickles down to the common man, prices have already risen, eating away at the worth of every dollar for a long while. Even Keynes recognized in some of his writing that quantitative easing causes some inequality. Interestingly enough, the industry most affected by quantitative easing, banking, has the largest degree of inequality from employee to CEO.

The evidence of the present boom is all around: inflation — yet it is not where one expect. Corporations, like McDonald’s, have accumulated so much debt that it negates their yearly earnings, yet their stock prices continue to exceed expectations. Indeed, the stock market is at an all-time high. Many economists see this as a bubble much like the “dot-com boom” in the late nineties and the most recent cause of the 2007 crash.

The current steady, unemployment rate, 4.4%, is at its lowest since then, 2007, according to the Bureau of Labor Statistics. Other indicators in the labor market include the increased job mobility, meaning it is easier to switch jobs for the average worker. Some parts of the labor market do not indicate this inflation. For example, the average wage of workers has not increased to meet the inflated prices. Mainstream economics’ explanation of sticky wages is that because modern jobs are further removed from capital, they tend to reflect inflation less.

Much of the existence of the Federal Reserve, or the Fed as it dubbed, is predicated on the efficacy of quantitative easing or QE and centralized control of the money supply respectively. Quantitative easing is the adding of newly printed money into the economy; the practice, in turn, artificially lowers the interest rate, making credit for enterprise cheaper.

John Maynard Keynes, a Nobel economist of Oxford, proposed what is now known as “Keynesian economics” or “demand-side economics”. The principle is that it is natural for the economy to slow down or even halt altogether; Keynes prescribed for a recession that a central bank increase the supply of money in an economy and the government lower taxes, taking on debt. The new money would boost aggregate demand or overall consumption; moreover, theoretically speaking, the government could increase taxes, cut spending, and pay for the debt it has accumulated once the economy has recovered.

Friedreich A. Hayek, a Nobel economist of the University of Freiburg, proposed the Theory of the Business Cycle of the Austrian School of Economics. The Austrian School is one of the oldest schools of economic thought while the Oxford School is its contemporary rival.

“The curious task of economics is to show to men how little they really know about what they imagine they can design.”-F.A. Hayek

The methodology of the Austrians is praxeology, the study of human action as a branch of logic. Another branch of praxeology, for example, is game theory. In short, the Austrians surmise that economics is not a natural science like biology or physics, rather a branch of logic like mathematics; thus, they do not use statistics or the scientific method to prove economic law — only to demonstrate it. When a supposed statistical discrepancy arises, it is presumed that something must be skewed or slighted about the statistics. To draw a parallel with math, if a student were to draw a right triangle that did not follow the Pythagorean Theorem, the assumption would be that the right triangle was drawn and/or measured incorrectly – not that the logic of the Pythagorean Theorem were faulty.

In essence, the boom, according to Hayek, is when the real damage to the economy is wrought; artificially low interest rates do not reflect the amount of savings for future consumption (the more savings, the cheaper the interest rate), yet cheap credit is a signal for entrepreneurs to borrow money and begin long-term projects. At the same time companies expand, consumption remains steady. This “tug-of-war” for resources causes prices to sky-rocket. Eventually, these long-term projects lose steam because of high prices and do not return investments without future savings. Interest can be thought of as the price of money in relation to time, so tampering with the interest rate causes a timing mismatch between the consumer and entrepreneur. The boom witnesses laborers diverted from other fields to “bubbled” industries such as real estate in the 2007 bubble.

Hayek was the strongest dissenter of Keynes; indeed, the two maintained a steady correspondence, arguing on grounds of methodology, assumptions, and evidence, but the Oxford School eventually prevailed in the public eye. Indeed, as Richard Nixon put it, “we are all Keynesians now.” Despite their school’s popularity, Keynesians have many modern dissenters, including Robert Murphy of the Mises Institute. Here is his official profile: https://mises.org/profile/robert-p-murphy

One Keynesian is possibly the most famous American economist of our time besides Milton Friedman: Paul Krugman. Here is an official profile of him: http://www.biographyonline.net/nobelprize/economics/paul-krugman.html .

If all of this sounds like doom and gloom, the silver lining may be that those in charge of the Federal Reserve and the government do not think a crash is on the horizon. In fact, Fed chairlady Janet Yellen stated at a London conference this past June “would I say that there will never, ever be another financial crisis?” she answered “you know probably that would be going too far, but I do not think we are much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.”

President Donald Trump has also taken credit for the boom, yet economists have accredited the President with very little of the recent uptake because of the Fed’s measure and because very little indeed has changed about taxes or regulations to make an aggregate difference as of the first year of his presidency. Economists would also admit that if the economy were to halt, it would not be the fault of the president entirely; although, many on the left saw the crash of 2007 as a result of the lax regulation of President George W. Bush, so it is likely such blame would be to the President whose approval ratings are low.